- info@prosperitypathway.ca

- Mon - Fri 09:00-17:00

Attain a clear financial vision, consolidate your debt or improve cash flow management – our team will help you embark on the desired lifestyle you desire.

Process implemented

Financial assessment: Evaluate clients’ current financial situation, including their income, expenses, debt, savings, and investments.

Debt reduction: Provide guidance and support to help our clients reduce or eliminate their debt, develop strategies to manage debt, and improve their credit score.

Investing: Provide advice on investment strategies, risk management, and portfolio diversification to help clients grow their wealth over time.

Retirement is a major life transition that involves a significant change in a person’s daily routine, social connections, and financial situation. While many people look forward to retirement as a time to relax and pursue their interests, others experience a range of emotions, including anxiety, fear, and sadness, as they face the uncertainty of this new phase of life.

The emotional aspect of retirement is closely linked to finance because retirement often involves a significant reduction in income and a shift from earning to living off of savings or retirement benefits. This can be a source of anxiety for many people, especially if they have not adequately saved or planned for retirement.

Do I have enough to retire?

Am I invested the right way?

When should I start CPP (Canada Pension Plan)?

Retirement planning involves managing risks to ensure a comfortable and secure retirement. There are several risks that people face, including market risk, longevity risk, inflation risk, and health care risk. Our team will help you understand and mitigate the latter through a robust plan.

Retirement withdrawal strategy that needs to be implemented is as important to ensure that you have a steady stream of income regardless of how the market is currently doing. The overall strategy will depend on how you perceive risk (overall risk tolerance), how much you want to withdraw out of your portfolio along with your savings and investments.

Our team is here to help remove the stress of retirement planning and give you peace of mind by guiding you step by step and ensuring that you have the confidence of living the life you desire.

Living a purpose driven life now and in retirement:

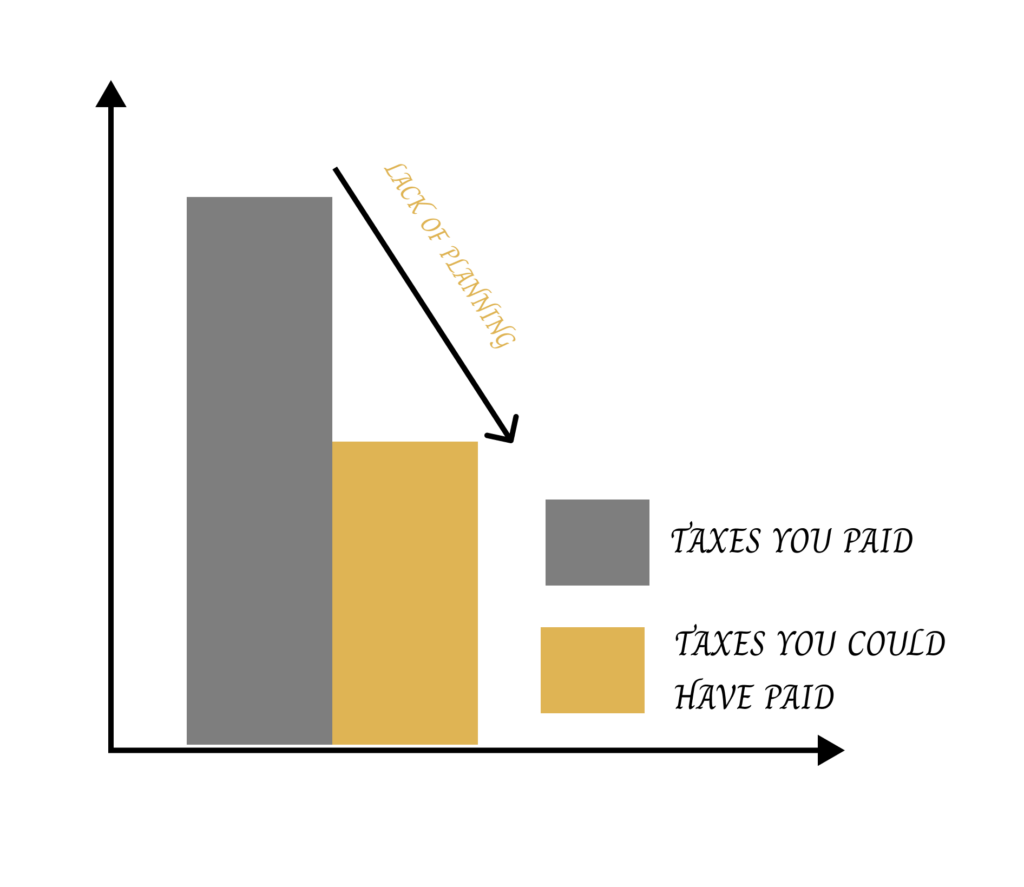

It is crucial to pay taxes, just no more than you need to. The right recipe here is fundamental to achieving financial goals.

Are you paying the right amount of taxes (are there any other techniques that could have been implemented to reduce your tax bill). Taking advantage of tax deductions is vital to overall financial success; with the help of our professionals, we work closely with our clients to identify all available tax deductions and credits that they may be eligible for including charitable donations, mortgage interest, business expenses, education expenses, and retirement contributions.

Tax efficient strategies are paramount both when choosing your investment vehicle and when working on withdrawal strategies. Not only does it help with the current cash flow, but also it will have an impact on your investment bucket 10-20 years down the road.

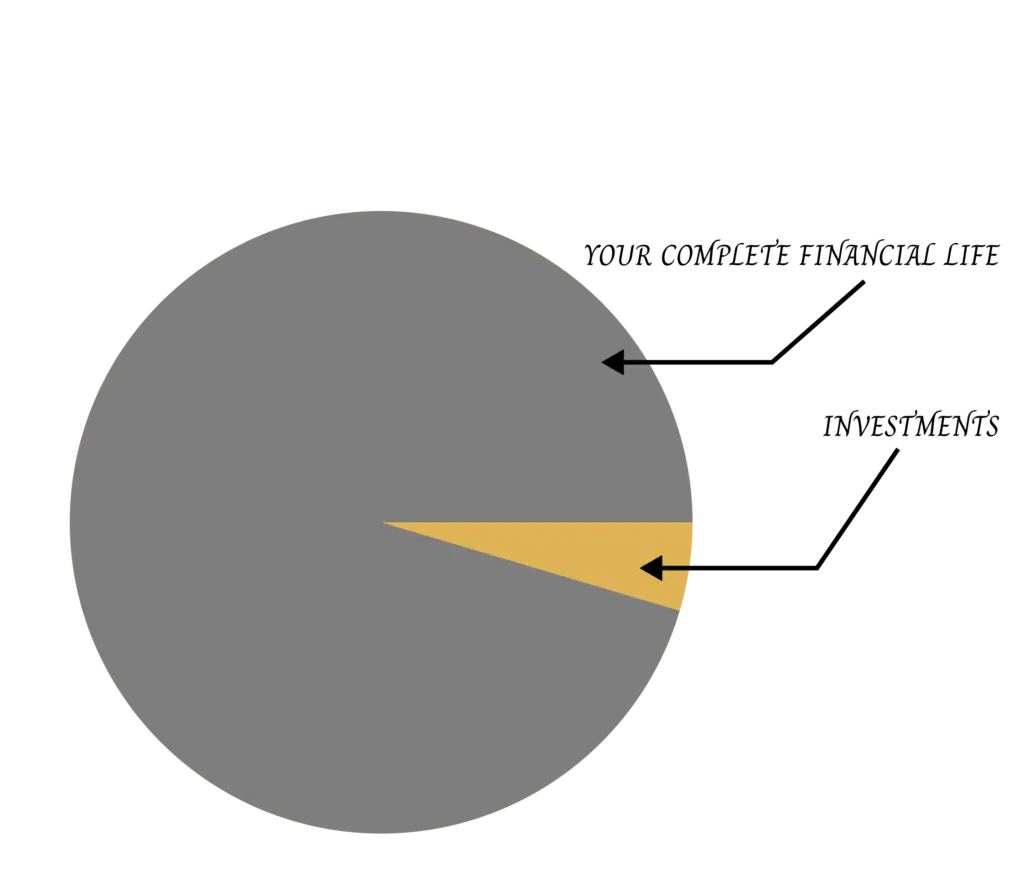

Our clients deserve an unbiased second opinion. And since we don’t manage assets for our clients, we objectively assess investments and recommend different strategies that improve portfolio performance.

Help clients with wealth transfers, wills, trusts, estates and work with accountants; lawyers to ensure your wishes are executed accordingly.

We assist the process of transferring assets i.e gifts, charitable donations, and transfers of property. We help clients manage their estates and ensure that their assets are distributed in accordance with their wishes.

"Susan has been a trusted advisor for me for the last few years. On managing my financial portfolio, her advice is always spot. I would not hesitate to recommend Susan to anyone looking for expert advice on building a healthy financial portfolio or for planning for their retirement."

"Working with Susan has been a game-changer for me. She took the time to understand my financial goals and created a comprehensive plan to help me achieve them. She is knowledgeable, responsive, and always takes the time to answer my questions. I highly recommend her to anyone looking for a skilled and trustworthy financial professional."

"I have been working with Susan for several years now, and I couldn't be happier with the level of service she provides. she has helped me navigate complex financial situations with ease, and his advice has always been spot-on. She is patient, kind, and truly cares about her clients. I have recommended her to several friends and family members, and they have all had similarly positive experiences."

"I was hesitant to work with a financial planner at first, but Susan made the process so easy and stress-free. She explained everything clearly and took the time to answer all of my questions. She helped me create a plan to pay off my debt and start saving for the future, and I am so grateful for her help. I would recommend her to anyone looking for financial guidance."

We talk about behavioral and emotional biases around money conversations and help clients to find ways to adapt to them.